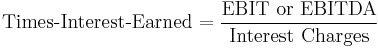

Times interest earned

Times interest earned (TIE) or interest coverage ratio is a measure of a company's ability to honor its debt payments. It may be calculated as either EBIT or EBITDA divided by the total interest payable.

Interest Charges = Traditionally "charges" refers to interest expense found on the income statement.

Times Interest Earned or Interest Coverage is a great tool when measuring a company's ability to meet its debt obligations. When the interest coverage ratio is smaller than 1, the company is not generating enough cash from its operations EBIT to meet its interest obligations. The Company would then have to either use cash on hand to make up the difference or borrow funds. Typically, it is a warning sign when interest coverage falls below 2.5x.

See also

EBITDA considered to be a better measure of Interest Coverage ratio.